What Is Credit Repair Australia? And How It Works?

Best credit repair Australia is what many Aussie people are looking for, they want credit repair company tips because they have poor credit. Many people worldwide use credit repair to fix bad credit history that is causing them problems.

Bad Credit is frustrating, especially in your financial life. Acceptance for credit cards, loans, autos, and even cell phone contracts may be challenging in today’s environment. The wisest strategy is to get your credit report fixed. The best way to fix your Credit is to hire an expert in the field of bad credit repair.

People who have bad credit can easily apply for credit repair online. Every citizen in Australia needs to take the help of the online credit repair process to rebuild their credit rating.

This is because when you have Bad Credit, it affects your ability to get good loans. You may even face higher interest rates if you provide unsecured loans or if you offer unsecured loans that need collateral.

This article will help you find contact information for credit repair companies that can help your situation.

What exactly is a credit score?

A credit score is a three-digit figure, typically ranging from 300 to 850, that assesses your ability to repay borrowed funds and pay obligations.

The data from your credit accounts determines your credit score. Credit-reporting organizations, often known as credit bureaus, collect this information and combine it into your credit reports.

Equifax, Experian, and Illion are the three most significant bureaus.

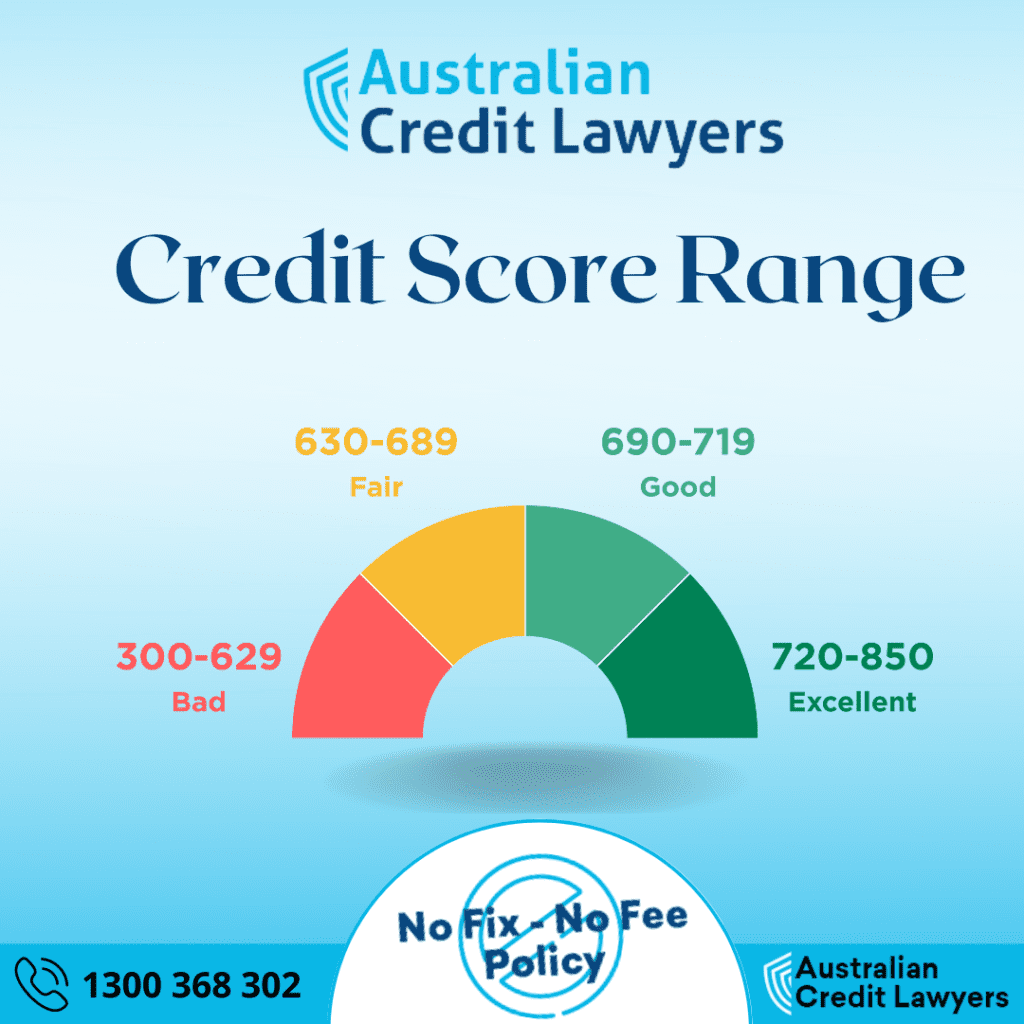

Ranges of credit scores

Creditors establish their criteria for what credit ratings they will accept; however, the following are basic guidelines:

- 720 or above is a credit score usually good.

- A credit score of 690 to 719 is excellent.

- Credit scores between 630 to 689 are fair.

- And credit ratings of 629 or below are bad.

In addition to your credit score, additional variables such as your income and previous obligations may consider by creditors when deciding whether to accept your application.

What is credit repair?

Credit repair refers to the practice of repairing an individual’s credit report by removing or adjusting inaccurate negative entries from a person’s credit report.

Cleaning up these postings as part of credit repair may help a person’s credit score. When someone asks for a loan, lenders will look at their credit score.

With a higher credit score and a good credit history, a person can obtain financing since they are seen as more responsible borrowers.

How does it work?

In the case of credit reports, a credit score is a numerical representation of the information in the report. Your creditworthiness will determine by the lender using this information.

The better your score is, the more likely it is that you will be able to repay loans and other forms of financial assistance. Credit Repair in Australia implies that you may start again and regain financial control.

For example, if you want to apply for a credit card but have a history of defaulting on your payments, the supplier may reject your application.

Clean Credit improves a customer’s listings wherever feasible to have the most excellent chance of getting accepted.

Your credit report can be requested for free from each of these three main credit bureaus: Experian, Equifax, Illion

The credit repair procedure

Step 1: Inquire.

When you contact ACL for a free credit repair consultation, one of our courteous representatives will ask you about the default listing and your current situation.

Clean Credit will then decide how best to assist you. We may also get your credit history to catch any errors you may have made.

Step 2: Research

The credit providers are then contacted for information, including copies of the notifications and file notes, to determine whether or not the negative listing was established correctly.

We utilize this information to analyze and find reasons for entirely removing the negative credit listing.

Step 3: Arrange a dispute

Following that, a dispute is produced, noting any mistakes in the procedure followed by the credit provider when listing your default. We also discuss your situation at the moment and elevate the issue so that the default listing is evaluated.

Step 4: Eliminate

Finally, we work directly with credit reporting companies such as Equifax and Illion to help you remove or repair your poor credit rating so you can go on with your life. Within four to six weeks of utilizing our services, 95 per cent of our customers will experience benefits.

Choosing the right service provider

Credit repair companies utilize credit legislation to evaluate if bad entries on your file are placed there by a credit provider who did not follow the applicable regulations.

Since they are specialists, these organizations know what to check for and who to contact to get any removal of inaccurate listings from your report.

The exact costs may vary across credit repair companies, but you can expect to spend between $500 and $1,500 to have a listing erased from your file. Typically, you pay each listing deleted.

The procedure varies depending on the service, but it generally includes the following steps:

The first, consultation.

An introductory talk to discuss the credit restoration procedure may be given to you. This should be complementary, and its purpose is to determine if the process will satisfy your requirements.

Examine your credit report.

Following that, your credit file is reviewed, and the first cost is assessed. This stage is used to determine if there are any inaccurate listings that can be deleted and whether there are any proactive steps that can be taken to enhance your score.

Apply formally for credit repair.

If you wish to proceed, you must officially apply for credit repair. You must choose which defaults or inaccuracies you want to analyze and erase, and each will incur a fee.

Making contact with creditors.

If your application is accepted, the credit repair firm will contact creditors to evaluate which defaults may be erased from your file. If you owe money to your creditors, certain credit repair agencies may be able to work out a payment plan with them.

Listings have been deleted.

Listings are deleted from your file if successful. For each listing that is successfully removed, you will be charged a fee.

How to evaluate Best Credit Repair Company?

There are a few credit repair companies that serve Australian customers. However, there are a few key criteria to consider when determining whether or not an agency is reputable:

- Licenses. Check for an ABN at the bottom of the company’s webpage.

- Transparency. How open is each company about the costs? Look for a business that presents you with all of the terms and conditions before you give over any money.

- Reputation. Is the business a well-known brand in the industry, or does it have a bad reputation? Look for a business that is well-known and has a track record of providing excellent service.

- Customer feedback. Examine internet review sites to learn about other people’s experiences with agencies. This provides an excellent indication of how each business handles its consumers.

- Total cost. Look for the greatest mix of low cost and high-quality service.

Explore this Related Topic: Credit Repair: Think No one Can Fix Your Credit?

Creating your credit repair plan

Set goals and improve your credit score.

If you discover inaccurate entries on your credit report, you may attempt to repair them for free. You may immediately contact the credit reporting agency that issues your report (such as Equifax or Experian) and request them to remove that listing. If they refuse, you may seek assistance from Ombudsman, an external dispute resolution agency, to settle your issue.

If you have genuine bad listings on your reports, such as bankruptcy or defaults, they may stay on your report for two to seven years, depending on the specific listing.

You may, however, increase your score by developing some good money habits:

- Make your payments on time. Late payments and defaults may have a negative impact on your credit score, so it’s critical to make the minimum payment on time for each statement month. If you use a credit card, it’s best to pay off your amount as soon as possible or in whole each month to lower your interest payments.

- Defining debt consolidation is the act of consolidating all of your obligations into a single monthly payment. If you have a lousy credit scorecredit score as a result of your inability to repay multiple credit card or loan obligations owing to interest costs, you may consolidate your debts into a single account with a 0% balance transfer offer.

- For a limited time, these cards do not charge interest on transferred funds (which can sometimes be as long as 26 months). On Finder, you can begin comparing balance transfer cards and learning how they operate.

- Reduce your credit limit. Additionally, the quantity of accessible credit has an effect on your credit score.

- If you have a high credit line that you are not using, you may want to consider lowering it. This will not only reduce the desire to overspend but may also improve your credit score.

Is it worthwhile to repair one’s credit?

The value of credit repair may vary depending on your circumstances. If you discover an erroneous listing that will stay on your credit report for many years, it may be worth contacting a credit repair agency to erase it.

Even a professional cannot delete a legitimate listing from your report. It would be useless to seek the help of a credit restoration firm in this scenario.

The benefits and drawbacks of Credit Repair Australia

Pros

- Boost your credit score. Removing bad entries from your credit record and practicing good repayment practices can boost your credit score.

- Increase your chances of getting a loan. Lenders evaluate your risk as a borrower based on your credit record and score. If you erase any erroneous black marks from your credit report and raise your credit score, your chances of acceptance for a credit card or loan should improve in the future.

Cons

- Charges and fees The credit restoration procedure may be costly if you hire a credit repair service. However, if you get your finances in order, the advantages may exceed the expenses.

- There are no assurances. There are no assurances that your bad listings can be remove by the credit repair business. If the black marks are genuine, you must wait until the time limit expires before they will delete from your report.

Credit repair is an excellent method to raise your credit score and get your finances back on track. If you make the decision to seek help from a credit repair service, be sure to evaluate your choices and balance the expenses against the advantages before making a commitment.

Our Expert and Best Credit Repair Australia team is standing by to assist you!

ACL Credit Repair Team

This article is just a high-level overview of the often ask topic, “How does credit restoration work?” Australian Credit Lawyer specializes in determining the most efficient ways for administering credit repair solutions on our customers’ behalf.

Hundreds of Australians have fixed their credit files and improved their credit scores with the assistance of our highly qualified, motivated advisers, enabling them to regain financial independence.

Best Credit Repair Australia Company

Australian Credit Lawyer may assist you in regaining financial control. We support your legal rights and think that individuals should not suffer as a consequence of others’ carelessness and disrespect.

Our solutions are as clear, straightforward, and fast as we can make them. With our assistance and help, you will be able to re-establish your financial footing and confidently apply for credit in the future.

We understand credit history and use our knowledge of your circumstances to ensure that it properly reflects your capacity to repay debts and manage your money.

We will give you the finest services for obtaining financing.

- Removal of Incorrect Default

- Disputing Invalid Inquiries

- Court Judgements

- Worst Repayment History Disputes

- Debt Negotiation

- Fixing Identity Theft on Credit File

So what is Best Credit Repair in Australia?

This is a great help if you have been struggling to get your finances in order. This is not the end. Your best option is to seek out credit repair from an experienced credit lawyer in your local area.

Australian Credit Lawyer is a good way to ensure your banking details remain safe with one hand while helping you rebuild your credit record.

We can help you solve problems that no other avenue can, such as credit card debt, medical expenses, or car finance. Dial your phone now and let us discuss your options with one of our knowledgeable lawyers.

Sign up for FREE CREDIT ASSESSMENT now!

Contact Us:

1300 368 302

help@australiancreditlawyers.com.au