Is Your Credit Score Affecting Your Life? Fix-It With Us

How do credit scores affect your life? Did you know 1 in 3 consumers lives with bad credit? If you’ve been denied to receive credit or make a big purchase because of your credit, you should probably tune in to this article.

This article contains information about how credit scores affect many lives and how to fix bad credit with the help of a competent credit repair company.

If you have bad credit, it can be challenging to improve it without the help of a professional. Yes. There are still many chances here for you to fix your bad credit.

What is the impact of credit scores on our lives?

Credit Scores Affect Your Life

A credit score is a numerical statement summarizing information in your credit report. It reflects your past and current payment behaviour on your financial obligations. Your credit score is calculated using informations in your credit report.

Credit reports contain information about:

- Where you live (address, city),

- What type of credit do you have (mortgage or auto),

- How long you have had credit (length of credit history),

- How you have handled credit in the past (payoff history),

- And whether you have made late payments, exceeded your credit limit or filed for bankruptcy.

Your credit report may contain negative information such as a late payment or bankruptcy, as well as positive information such as long credit history.

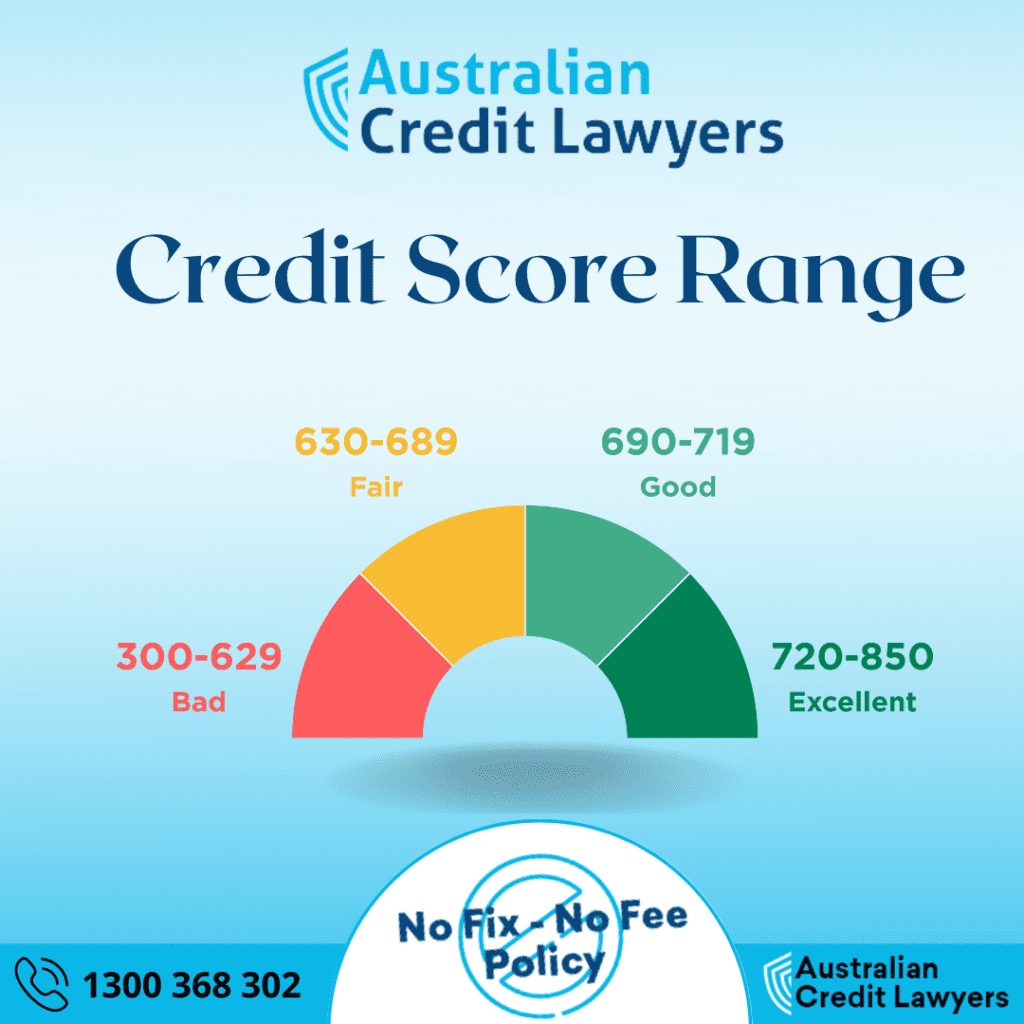

A credit score is a statement that ranges from 300 and 850.

The better your credit score, the less risky you are as a borrower. Credit scores are obtained on a scale of 300 to 850.

Credit scores are used to determine your chances of repaying a loan, and hence have a significant influence on our capacity to borrow money.

Go check Experian, Equifax and Illion for more facts about credit scores.

How to Calculate a Credit Score: Quick Overview

To calculate your credit score, lenders compare your current information to your past information. By using your most recent information, lenders get a good idea about your creditworthiness. They want to know if you can be trusted with credit now.

If you’ve been approved for credit in the past, lenders could ask you to provide more recent information. They might want to see your most recent employment history, for example. When you provide this information, it may help your credit score.

If you’ve already been rejected credit, your lenders may reach out to potential creditors to ask if they can approve you for credit. If a potential creditor approves you for credit, that creditor may be willing to report you’re positive information to the new creditor. It may also help your credit score.

If you’ve been declined credit in the past, lenders may not reach out to potential creditors. However, your previous credit history and information may become a factor in future credit decisions.

What Hurts Your Credit Score The Most

Your Payment History

Payment history is probably the single most important factor in determining your credit score. Paying your bills on time is the most important thing you can do to improve your credit score.

Payment history goes back 10 years. If you have a good payment history, that history will continue to influence your score even after you close your oldest account. It’s very important not to close your old credit card or checking accounts.

All payment history counts. If you pay a bill late, it doesn’t matter whether it was a credit card payment or a utility payment. The payment history report will count both equally.

You can restore your credit score by paying your bills on time. But even if you pay your bills on time, your score won’t go up until you’ve had a good payment history for several years.

And that means not just paying your bills but closing old accounts and stopping new ones. Make timely payments on your invoices, or pay online.

Your Credit History

Your payment history is the most important, but the age of your oldest credit account matters too. So does the amount of credit you have used, and how long you have had accounts.

Your earliest account’s age, and the amount you owe on it, have the greatest impact on your credit score.

They represent two things:

- How skillfully you have previously managed credit.

- And how much credit you have available.

Credit bureaus report that information every 30 days. So if you pay on time, your score will go up. If you keep an older account open, your score will go up but if you open several new accounts, your score will go down. These adjustments are automatic.

Your Debt

You have bad credit because you haven’t paid back your loans

You have three main kinds of debts.

First, you have debts like your mortgage and your car.

These debts require monthly payments, and your monthly payments are based on your credit limit, which is a number between $10,000 and $100,000. Your credit card issuer has to report this number to credit bureaus, and these credit bureaus have to report to the three national credit bureaus.

The credit bureaus report your balances to your lenders, and your lenders report to the credit bureaus. To keep your score good, you have to make your payments on time.

The second kind of debt is credit card debt.

This debt does not have monthly payments, and your credit limit is the amount you borrow. When you pay off your credit card balance, your credit score usually goes up.

The third kind of debt is unsecured debt.

This includes things like payday loans and medical bills. Unlike the first two kinds of debts, these debts don’t have fixed payments. They don’t have any payments at all.

As soon as you begin to fall behind on payments, your credit score will plummet. If you miss payments on unsecured debt, you won’t be able to get a new credit card or a telephone.

When you have unsecured debt, the best way to pay them off is to borrow as little as possible and pay it all off as quickly as possible. Most people don’t pay down unsecured debt, so their score stays low. If you have unsecured debt, the best thing is to get rid of it.

Interest

The interest rate you pay on a loan affects your credit score, which is used by lenders in deciding whether to grant credit to you.

Your credit score is a number between 300 and 850. The higher your score, the more chance it is that you will get credit. Lenders use your credit score to help them decide whether or not to grant you credit.

New Credit

Having new credit accounts can be a part of how people build wealth. But new credit is also part of how people get into debt.

If you have new credit, your credit report will show it. Lenders see your credit report and decide whether to give you credit. If your credit report shows that you don’t have much credit, lenders may worry that you won’t be able to pay them back.

New credit is also part of how you rebuild your credit. Lenders give you new credit accounts in the hope that, by making the minimum payments on those new accounts, you will rebuild your credit.

But many people don’t have enough income to make the minimum payments on new credit accounts. And if you can’t pay the minimum payments, any payment you make on-time will be counted against you. This will lower your Credit Score, making it harder to get credit.

People who open lots of new credit cards, even when they’re paying them off every month, see a big drop in their scores. Opening new credit cards, especially multiple cards, is a signal to creditors that you aren’t managing your debt. And that’s not a good look.

Other Credit Information

Accounts that go delinquent. Negative account information such as:

Foreclosure

Bankruptcy

Repossession

Charge-offs,

And settled accounts may appear on your credit report.

Each of these may have a detrimental effect on your credit for years, if not a decade.

How to find the right credit repair solutions for you

If you have a bad credit rating and need to find credit repair solutions, there are a few things that you should know.

- First, you should understand that credit repair is not a process that just takes care of your credit problems. It is a process that will help to improve your bad credit rating and help you get credit in the future.

- The second point to remember is that credit repair is not as simple a process as many people think. It is not something that you will be able to do on your own. The best way to fix your credit problems is to work with a professional that has experience in credit repair.

- The third thing that you should know is that credit repair is a process that takes time. It will take time to recover your credit. Credit repair is a process that will not necessarily happen overnight. It will take time to see results.

- The fourth thing that you should know is that credit repair is a process that you are going to have to do on a regular basis. It is something that you have to stick with. If you stop this process, your credit score is going to get worse.

- The last thing that you should know is that credit repair is a process that can be expensive. It will cost more than you think.

Australian Credit Lawyer is available to help. We can help you with credit restoration and improve your credit rating. We work under the law and can help you.

Be aware of tricks and scams used by shady companies

Again credit score is affecting your life so the time is now to educate yourself on credit repair. However, unless you like paying an arm and a leg for poor results, beware of shady credit repair companies. There are many of them out there, and they are very good at creating a lot of false hopes.

So, how do you find a legitimate credit repair company?

Here are some tips:

1. Look for credit repair companies that provide a free consultation. These companies should be able to tell you exactly what they need to do on your behalf.

2. Make sure that the credit repair company you choose is certified by the Society for Ethical Credit Repair. They require their members to follow a strict Code of Ethics.

3. Make sure that your prospective credit repair company can truthfully say that they can repair your credit. Many companies say they can fix your credit, but they can’t.

4. Look for companies that provide extra services to improve your credit. Some companies offer credit monitoring services or provide other services that can improve your credit.

5. Hire a company that can make quick changes. It can take months for credit repair companies to improve your credit, so it is important to make sure that the company you choose can make fast changes.

6. Make sure that the credit repair company you choose is bonded and insured. Make sure they are bonded so that you can rest assured that your credit is in good hands.

7. Make sure that the company has positive testimonials. Testimonials from happy customers can provide excellent information about the company, so look for positive reviews.

8. Pay for credit repair with a credit card. This will give you some protection if the credit repair company doesn’t live up to your expectations.

Pick a company with proven track record.

Credit scores really affect your life so choose the best company!

When you have a good credit score, everything becomes easier. You get the best interest rates on loans and can find it easy to rent an apartment or buy a house. But when your credit is low, life gets much more difficult. If you are struggling with debt management because of this issue, call our experts at Australian Credit Lawyer today for help!

We have helped thousands of people in Australia whose credit is affecting their life and they get their lives back by improving their credit scores – all while keeping them within budget. With personalized service that’s tailored to your needs and goals, we guarantee results without any hidden fees! Call us today for more information about how we can help repair your damaged credit history!