Is Your Credit Report Accurate? Mistakes That Can Harm Your Credit Score

Do you trust the information in your credit report? Or do you worry that it’s filled with errors that could be damaging your credit score? If you do not check your credit report often, there are many things that can go wrong with it.

Whether you’re planning to buy a home, get a credit card or take out a car loan, it’s vital and critical that you check your credit report to ensure that the information in it is accurate.

Since lenders look at your credit history before deciding whether to approve you for a loan or credit card, even small mistakes in or misinterpretations of the information on your report can affect whether you get approval for your loan and at what interest rate.

Errors can happen when lenders fail to report information correctly or if identity theft occurs. Knowing what to look out for is essential.

Understand your credit score

An understanding of your credit score can have a significant impact on your life.

In the short term, it’s crucial to know how and where you stack up — if your credit score is close to 700, you’re in good shape. If it’s below 600, you could benefit from improving your score.

Your score can affect your ability to access credit, such as taking out a loan, buying a home, or renting a car in the long term.

Credit score, or FICO score, is based on several factors, including your payment history, how much debt you have, the length of your credit history and the types of credit you have.

Your score ranges from 300 to 850. Credit scores can vary from 300 to 850, with 850 being the highest score.

Is your credit report accurate?

Credit reports are critically important to your financial life. They allow you to secure loans, purchase a home, apply for a job, and, most importantly, prove to all creditors that you are worthy of a loan.

The credit reports contain three major sections:

1. Personal identifying information: this will include a name, address, date of birth, social security number and so on.

2. Credit information: this includes a list of credit cards, loans, mortgages, lines of credit and so on.

3. Public records and inquiries: this section details any public records and inquiries. Public records include tax liens, bankruptcies, foreclosures, child support and alimony payments, etc. Inquiries are the attempts made by the lender to check if you are eligible and qualified for a loan.

Errors or mistakes in your credit report can lower your credit score. If you discover an error on your credit report, dispute it. The credit bureaus are responsible for correcting the errors and recalculating your score.

Here are some common credit report errors:

- Incorrect Social Security number. Social Security number is the single most crucial piece of information on your credit report. It identifies you and serves as a unique identifier for your credit report. If your credit report contains an inaccurate Social Security number, it could cause problems.

A Social Security number can be linked to the wrong person if there are errors with the number itself, such as an incorrect digit or accidental transposition of letters.

- Incorrect address. Your address is meaningful because creditors often mail bills and statements to your home address. If a creditor has the wrong address, it could cause problems.

- Incorrect date of birth. Your date of birth is important because it affects your eligibility for certain types of credit. If your credit report contains a wrong date of birth, it could cause problems.

- Incorrect employer. Your employers are listed on your credit report, and lenders check those names against public records to confirm that you’re who you say you are.

Errors can happen for many reasons:

Incorrect information

Your credit report can contain errors caused by data entry errors or incorrect information received from creditors. If you find an error or a mistake on your credit report, first check with the financial institution that reported the error. If they’re unable to correct the error, contact the credit reporting agency that listed the erroneous information.

Identity theft

Identity theft is a rapidly growing crime. It’s becoming increasingly common for criminals to steal personal information and use it to open credit accounts under someone else’s name. If you discover an error or a mistake on your credit report, contact the reporting financial institution. If they can’t fix it, contact the credit reporting organization that listed it.

Fraudulent activity

Sometimes, someone will try to open credit accounts in your name without your knowledge. That can be a sign of fraudulent activity, such as identity theft. Any errors on your credit report should be verified with the reporting institution. Consult the credit reporting agency if they can’t fix the problem.

Related Topic: Credit Report Check: How Can You Find If Someone Access It?

Mistakes That Can Damage Your Credit Score

Lenders assess your credit score to determine your credit risk. So it’s no surprise that your credit score can affect everything from your ability to obtain a loan to the cost of insurance.

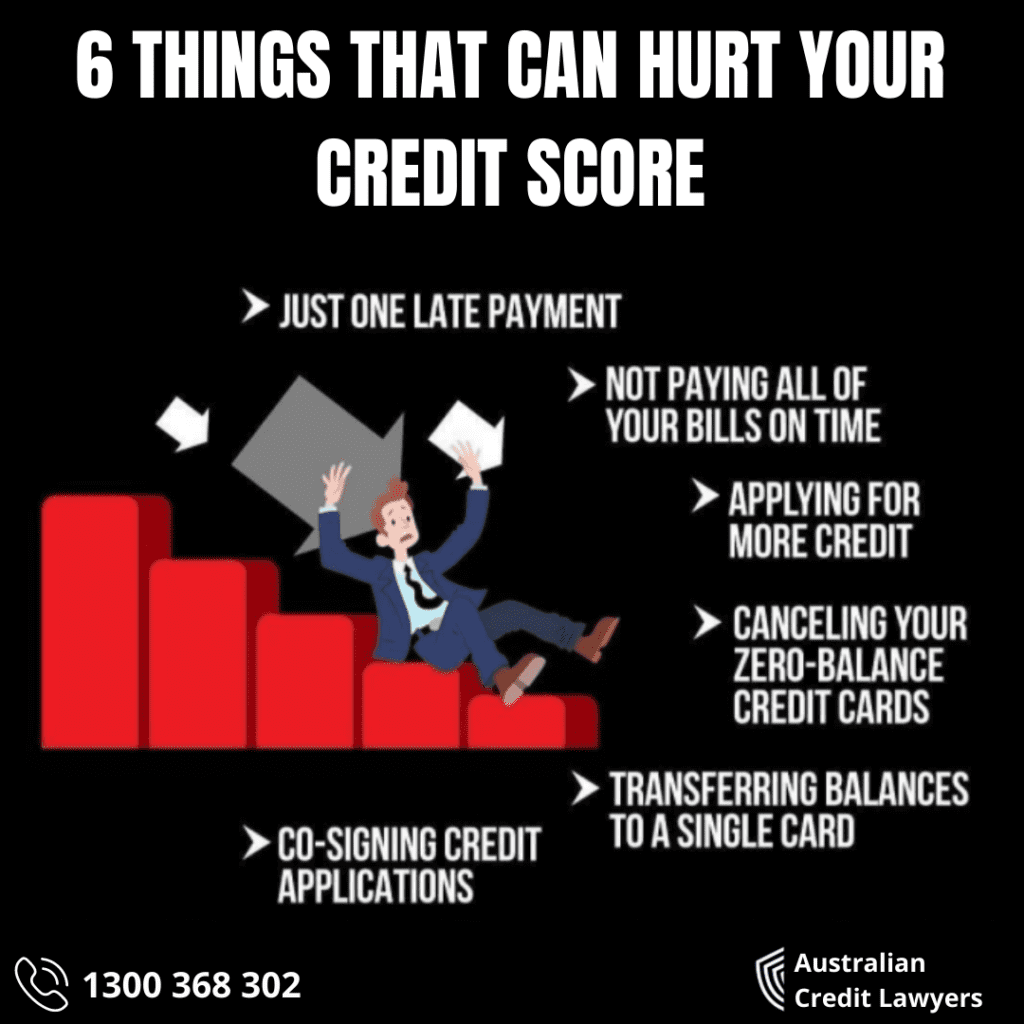

Here are six mistakes that can damage your credit score.

1. Running up debts. When your debts shoot up, your credit score takes a hit. For example, taking out a $10,000 loan on a credit card with a $5,000 limit and not paying the bill is bad news.

2. Failing to pay bills on time. When you miss a statement, it shows up as a “delinquent” on your credit report. Late payments can drop your credit score anywhere from 30 to 100 points, depending on how late the amount is.

3. Opening too many new credit cards. Opening more credit accounts than you can use at once can indicate that you’re desperate for money. This can hurt your score.

4. Closing old accounts. Closing an account is an excellent way to free up space in your wallet. But it also hurts your score because closing an old account reduces the amount of available credit on your credit report.

5. Applying for multiple loans or credit cards at once. Applying for new credit can lower your credit score. It’s best to apply for credit only when you really need it.

6. Lying about credit. Many people don’t know that it’s possible to have bad credit because of mistakes they’ve made. For example, lying about your credit score on a loan application can have the same effect as running up debts.

How can I verify if my credit report is accurate?

To get a credit report, a request must be made in writing. You may verify or get a free copy of your credit report from the three largest credit reporting agencies: Experian, Equifax, or Ilion. Agencies can’t charge you for the report, but they will add a small fee to your credit score.

Provide and specify your name, address, and Social Security number and date of birth in your request. If you’re married, your spouse’s name should be included, too.

The credit reporting bureaus must mail you a credit report within 30 days of your request. If it’s more than 30 days, contact the agency to find out why.

If your credit report is inaccurate, you can dispute the information directly with the agency that issued it. Less obvious hard inquiries, such as when you apply for a new credit card, are more difficult to resolve.

What Are You Doing to Protect Your Credit?

Credit scores are only numbers, but they’re also personal. They reflect the level of risk you present.

It’s impossible to predict when or under what circumstances your credit score could be compromised. But it’s essential to take proactive measures to help safeguard them.

So taking steps to protect your credit is essential.

Here are seven immediate actions to ensure an accurate credit report:

1. Check your credit report. There is no need for a credit review or credit check, but getting a free copy once a year of your credit report is a good idea. Look at it closely and check for any new accounts or derogatory marks

2. Pay your bills on time. Late payment fees are expensive, but they only affect your credit score temporarily.

3. Avoid debt. In addition to avoiding late fees, avoid getting into debt in the first place.

4. Get more credit. Having a lot of credit accounts but not using all of them can hurt your score. But opening several new accounts at once can raise a red flag.

5. Don’t close old accounts. Making that mistake can lower your credit score. And once you close an account, make sure it stays closed.

6. Guard your identity. Identity theft is a huge issue and problem these days. Make sure you monitor your credit score and your credit report for suspicious activity.

Are you doing enough to protect your credit report?

In Australia, credit reporting is compulsory, and most lenders and property managers can access credit reports. This means there’s a good chance that your credit profile will be visible to any potential lender or tenant.

Credit reports contain a set of information about an individual’s credit history. Lenders and property managers use this information to assess an individual’s capacity to pay and their ability to meet their financial commitments.

When creditors and debt collectors call you, you need to be able to defend your credit.

If your credit is being attacked or challenged, you need an Australian Credit Lawyer who understands the protections afforded to consumers by law.

Credit lawyers can protect you from credit providers who ignore your legal rights and advise creditors and debt collectors on how they must comply with the law.

Australian Credit Lawyers can assist with:

Removing Incorrect Defaults

Disputing Invalid Inquiries

Court Judgements

Worst Repayment History Disputes

Debt Negotiation

Fixing Identity Theft on Credit File

Our team at Australian Credit Lawyer specializes in helping individuals who believe that their credit report contains errors that negatively affect their personal finances.

Apply for FREE CREDIT ASSESSMENT now!

Ensure accurate credit report

I’m sure you agree now that the credit report is one of the most critical factors of your financial life. If you are considering buying a house, applying for a new loan, taking out a credit card, or starting a business, knowing how to read your credit report can save you from making severe mistakes with severe consequences.

Whether you are trying to protect your good credit score or make it higher, it would be wise or knowledgeable enough to spend some time understanding the habits that affect it.

Does your credit report contain errors? If it does, you might be in for more of a headache than you think. As stated in this article, some credit report errors can harm your credit score–in more ways than one.

So, make sure to safeguard your hard-earned credit score by checking your reports for any inaccuracies that could badly or negatively affect your credit score and work with a trusted credit repair expert who is professional and specializes in helping individuals with credit repair issues.